Investment Management

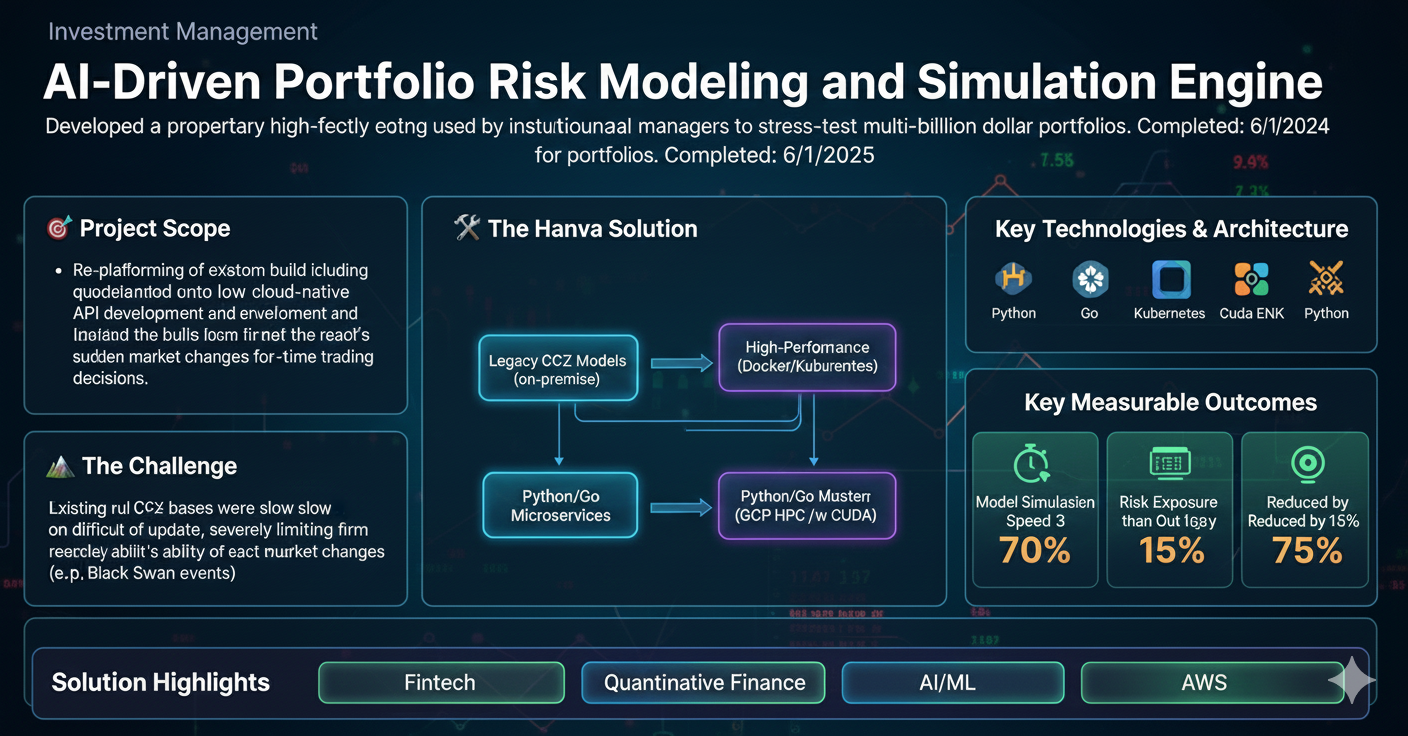

AI-Driven Portfolio Risk Modeling and Simulation Engine

Developed a proprietary, high-fidelity financial modeling engine used by institutional asset managers to stress-test multi-billion dollar portfolios.

Completed: 6/1/2025

🎯 Project Scope

Re-platforming of existing quantitative models onto a cloud-native HPC environment and building a low-latency API for real-time trading decisions.

⛰️ The Challenge

Legacy C++ models were slow and difficult to update, severely limiting the firm's ability to react to sudden market changes (e.g., Black Swan events).

🛠️ The Hanva Solution

Migrated models to a containerized Python/Go microservices architecture running on specialized high-performance clusters, allowing for thousands of simulations per minute.

Key Technologies & Architecture

- • Python

- • Go

- • CUDA

- • Kubernetes

- • GCP HPC